Changes in the global Airbnb offer during the COVID-19 pandemic

Airbnb is the most valuable tourism company in history and an epitome of the platform economy in tourism. Since 2020, together with the entire tourism sector, it has experienced the crisis caused by the COVID-19 pandemic. The paper presents the context for the current international research on Airbnb by describing the origin, current state, and possible developments of the platform offer during and after the pandemic. The data on the global Airbnb offer in 2018, 2019, and 2020 comes from web-scraping the platform website. It shows that the dynamic growth of accommodation supply stopped in the last year. The platform offer has continued to disperse geographically towards less saturated markets and rural areas during the pandemic period. Entire flats and apartments have been continuously growing in dominance in the structure of the listing, while the slower growth in the percentage of multihosts’ listings indicates a slowdown in the process of the professionalisation of the platform offer.

On the 10th of December 2020, Airbnb became a public company via an initial public offering on NASDAQ. Despite the pandemic devastating the tourism industry, Airbnb stock prices doubled on the first day after the IPO, making the company worth over 100 billion USD (Schaal, 2020a). A merely twelve-years-old firm became the most valuable tourism company in history. Airbnb epitomises the platform economy in tourism. It has gained public and scholarly attention not only due to its size and economic success, but also disruptive effects on hospitality industry and housing markets, and transformative impact on tourism production and consumption models (Guttentag, 2019).

The paper aims to present the context for the current international research on Airbnb by describing the origin, current state, and possible developments of the platform offer. The first part outlines the origin and core value presented by Airbnb to platform users, and how the platform is situated in the current market of Internet accommodation intermediaries. The second part uses web-scraped data from 2018, 2019 and 2020 to present the current state and recent changes in the platform’s size, geographic distribution, and structure of accommodations. The last part uses this data to add to the current discussion on the future of Airbnb and the platform economy during and after the pandemic.

Airbnb is one of the largest online accommodation intermediaries in the world. It offers 5.6 million homes, apartments, and rooms in almost all countries (Airbnb, 2021). Airbnb’s marketing efforts attempt to portray it as a qualitatively new form of tourism service production and consumption. However, the platform founders did not bring a completely new idea to the market. Rather than that, they creatively built on three models of tourism services development that were already present on the market:

- The exploitation of a two-sided market model with the platform as an intermediary between dispersed providers and dispersed consumers. This model was previously utilized by online travel agencies such as Booking or Expedia, yet Airbnb built a platform that is particularly attractive for small-scale hosts.

- Basing itself on a dynamic market of holiday rental of homes and apartments, which fits into the more general trend of the use of housing for purposes other than permanent residence (Doling, 2019). Airbnb contributed to the extension of tourism rental apartments from leisure resorts to major cities.

- Airbnb development was inspired and contributed to the spread of the idea of the sharing economy or collaborative consumption (Dredge & Gyimóthy, 2015). Airbnb enables hosts to use their underutilized assets (apartments or rooms), while the platform employs sharing narrative to market its service as a novel and sustainable form of economic activity.

Airbnb is not the only platform providing peer-to-peer accommodation in private homes and rooms. Table 1.1. lists major global platforms offering similar services. Airbnb appears to be one of the youngest (excluding Chinese competitors), yet the largest network of peer-to-peer hospitality.

Table 1.1. Selected homesharing platforms

| Platform | Established | Headquarters | Rental model | Platform revenue | Platform size |

| HomeExchange | 1992 HomeExchange, 2011 GuestToGuest | Paris, France | Guest points earned for hosting for paying for stays | Membership fee paid by users | 450k homes in 187 countries |

| Vrbo | 1995 VRBO, 2005 HomeAway | Austin, USA | Paid | Subscription paid by hosts or commissions from bookings | Over 2M offers |

| Booking.com | 1996 | Amsterdam, Netherlands | Paid (mainly hotels, but also homes and apartments) | Commissions from bookings | About 2.4M offers of apartments, homes, homestays etc. |

| TripAdvisor Rentals | 1999 HolidayLettings, 2004 VacationHomeRentals, 2005 Niumba, 2007 FlipKey, 2009 HouseTrip | Needham, USA | Paid | Subscription paid by hosts or commissions from bookings | More than 830k properties in 190 countries |

| Couchsurfing | 2004 | San Francisco, USA | Free | Membership fee in some countries; optional verification fee | 14M members |

| Airbnb | 2008 | San Francisco, USA | Paid | Commissions from bookings | 4M hosts, 5.6M offers in over 220 countries and regions |

| Wimdu | 2011 | Berlin, Germany | Paid | Commissions from bookings | Over 350k offers |

| Tujia | 2011 | Beijing, China | Paid (also hotels) | Commissions from bookings | Over 1M offers, mainly in China |

| Xiaozhu | 2012 | Beijing, China | Paid | Commissions from bookings | Over 500k offers, mainly in China |

Source: own elaboration based on Hajibaba & Dolnicar, 2018; Feng, 2019; platform websites.

Airbnb does not publish any detailed data on the structure, geographic distribution, and use of accommodation offers available on the platform. It is possible however, to obtain such information indirectly from the platform webpage using automated web-scrapers. Such web-scraped data is widely used in research e.g., on hosts’ and guests’ behaviour and impacts of Airbnb rentals on the housing market. Most authors utilize datasets compiled, archived, and published by two websites: commercial AirDNA and non-commercial InsideAirbnb. It limits the geographic reach of analysis to individual cities in most cases. Infrequent studies on the global spatial scale indicate great geographical variations in the size, structure, and intensity of Airbnb’s use (Adamiak, 2019; Ke, 2017).

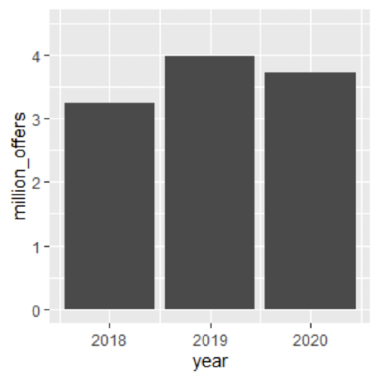

The following parts of the paper will present some general information on the size, distribution, and structure of Airbnb offers in the last three years based on three web-scraping sessions performed in September–October 2018, September 2019 and November 2020. A web-scraping script by Slee (2018) was used. It does not guarantee the inclusion of all listings offered at a given time. To filter inactive, erroneously posted, or duplicated listings, only listings with at least one review were included in the datasets. Figure 1.1. shows how the size of rental stock continued to develop until 2019, reaching c. 4 million listings, and dropped by 6.5% until November 2020 as an effect of the COVID-19 pandemic.

Figure 2.1. Number of Airbnb offers with at least one review in September–October 2018, September 2019 and November 2020

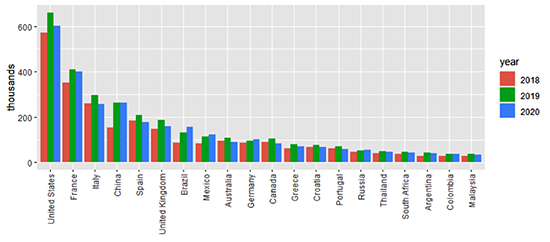

Airbnb listings are most numerous in the Americas, Europe and East Asia (Fig. 2.2.). One-sixth of the global supply is located in the birthplace of the platform – the United States. Among European countries, France, Italy, Spain, UK and Germany are the most prominent platform markets. Apart from these countries, China, Brazil, Mexico, and Australia complete the top ten countries’ list. Other large Airbnb markets include smaller European countries, countries of the Americas and South-East Asia. The smallest numbers of offers are typical for countries of Africa (apart from South Africa), Central and South-West Asia. In all countries, the size of the Airbnb rental offer grew until 2019. The fall during the pandemic had different volumes in individual countries. There were less listings in South European countries such as Italy and Spain at the end of 2020 than in 2018. In most countries, the number of listings fell relative to 2019, but not below the 2018 level. In some countries (e.g., Brazil, Russia), the rental offer size continued to increase during 2020 despite the pandemic.

Figure 2.2. Number of Airbnb offers with at least one review in top 20 countries

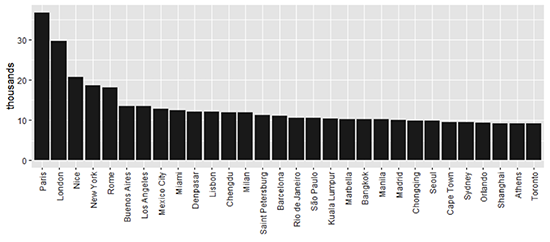

Figure 2.3. presents the numbers of listings located in the largest Airbnb destinations. Unlike in most publications, destinations are not delimited using administrative criteria. Instead, a data-driven delimitation is employed. Thus each destination represents a local concentration of Airbnb listings in a small area. Destinations were delimited using a DBSCAN density-based clustering method (Hahsler et al., 2019) with parameters eps=1 km and minPts=3. The most prominent Airbnb destinations appear to be the global cities of Western Europe (Paris and London by far exceed the numbers for other destinations) and the Americas and East Asia. Apart from large cities, leisure destinations stretching beyond individual cities’ limits are on the list, such as Nice, Denpasar, and Marbella.

Figure 2.3. Number of Airbnb offers with at least one review in top 30 destinations

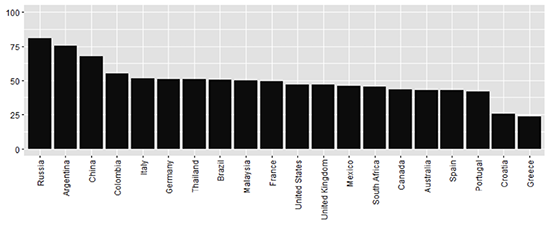

In literature, Airbnb is often portrayed as an urban phenomenon. Yet, globally only half of the offers are located in urbanised areas (defined as within the urbanized areas’ extents according to Natural Earth (2021) geographic database). The remaining part is located in smaller towns, resorts, and rural areas. When comparing countries in terms of the shares of urban listings, we can see that platform offers are primarily concentrated in cities in Eastern European and Asian countries. Southern European countries, in turn, have the highest share of rural listings, due to their frequent location in coastal areas (fig. 2.4). Over the last three years the share of urban listings has dropped from 53.6% in 2018 to 49.1% in 2021, and this trend has accelerated during the pandemic.

Figure 2.4. Percent of Airbnb offers located within urban areas in top 20 countries

The use, value, and impacts of Airbnb offers vary according to the types of accommodation offers. In the discussion on impacts and regulations of short-term rental, a distinction is often made between non-professional (mom-and-pop or peer-to-peer) and professional (commercial, for-profit) hosts (Dolnicar, 2019; Wegmann & Jiao, 2017). The former ones rent out one room of their home or entire home when they are on vacations. They may also rent out their second home. Professional hosts, in turn, use apartments and homes only for rent. They may either own them or manage properties on behalf of the owners (Oskam, 2019). Airbnb is also used as a distribution channel by hotels, bed-and-breakfasts, and other catered accommodation providers. The distinction between professional and non-professional listings in legal regulations and studies is often made based on:

- hosts presence in the apartment,

- maximum number of rental days per year,

- type of listing (room or entire home/apartment) or

- number of listings hosted by a single host (Adamiak, 2019; Dolnicar, 2019; Oskam, 2019; Wegmann & Jiao, 2017).

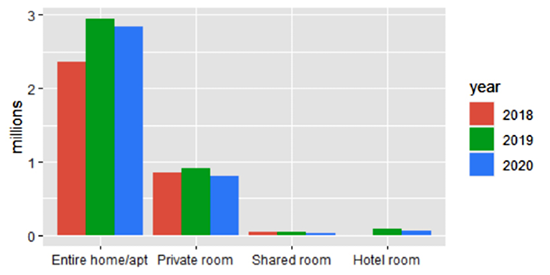

In the current study database, the last two characteristics were taken into account. The dominant type of accommodation offered on Airbnb is entire home or apartment (fig. 2.5). Its share in the total listings has been growing both before the pandemic (from 72.6% in 2018 to 74.1% in 2019) and during the pandemic (to 76.2% in 2020). The share of private rooms has declined from 26.2% in 2018 to 21.6% in 2020. Hotel rooms (introduced as a separate category in 2019) and shared rooms represent minor proportions of listings.

Figure 2.5. Types of Airbnb offers with at least one review

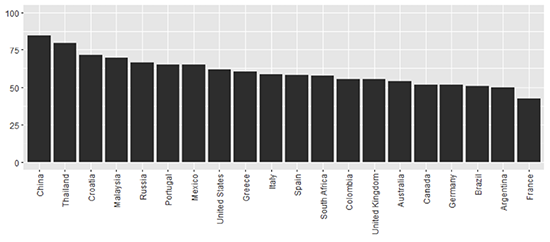

As many as 59.8% of all listings are offered by multihosts – hosts providing more than one listing. This share has grown from 56.6% in 2018, even though the growth slowed down in the recent year. 15.1% of offers belong to hosts with more than ten listings, and 5.2% to hosts with more than 50 listings. The record number of listings offered by one host is 2,649. Fig. 2.6 shows that there are differences between countries in terms of the extent of multihosting. In general, countries of Asia and Eastern Europe have the largest proportion of multi-hosted listings, while in western European and South American markets, single hosts appear more often. Still, among all the 20 top Airbnb markets, only in France do single hosts own the majority of offers.

Figure 2.6. Percent of Airbnb offers owned by multihosts in top 20 countries

Before the pandemic outbreak, Airbnb focused on developing the hotel and professional hosts’ offer to expand to profitable segments of business and luxury travel (Dogru, Mody, & Suess, 2019). The company acquired other platforms, created customised brands (e.g., Airbnb for Work, Airbnb Plus), and modified platform mechanisms to better suit professional users. This trend was confirmed by the disproportionally rapid growth in professional hosts’ offers noticeable in web-scraped data. The company’s long-term strategy was to expand its offer to tourism services other than accommodation and to build “an end-to-end travel platform”. It was only partially realised by adding “Experiences” and “Restaurants” products.

The pandemic heavily affected all travel industries, including Airbnb, which experienced a 30% year-to-year fall in revenues and a net loss of USD 4.59 billion in 2020 (Jelski, 2021). The crisis moved the platform’s attention away from the expansion to new tourism services. Instead, the company CEO strategizes to refocus on accommodation and microentrepreneur hosts (offering several offers) and more extended stays (Schaal, 2020b). Studies forecast different futures that the current tourism industry crisis may bring to Airbnb. Many expect the supply to stop growing, primarily due to the exit of professional hosts from the platform (Dolnicar & Zare, 2020; Zhang et al., 2020), and a partial return of housing from Airbnb to the permanent housing system (Farmaki et al, 2020; Kadi et al., 2020). Others indicate at a chance platform rejuvenation created by customers’ preference to rent entire flats over hotel rooms due to social distancing requirements (Bresciani et al., 2021).

Data evidence shows some processes evident in the platform offer before the pandemic became even more visible during the current crisis. It includes geographic decentralisation from the USA South-Western Europe to less saturated national markets, and from urban towards rural areas. In terms of accommodation structure, the dominance of apartments and homes in the structure of offers has increased, while multihosts’ offers stopped expanding, confirming the slowdown in the process of platform offer professionalisation. These processes may be interpreted both as a deceleration of the platform evolution, and its rejuvenation. The stock market success of the company suggests that the COVID-19 pandemic has not brought the homesharing model to an end. Yet, it will continue to redefine the tourism experience economy in the future.

ADAMIAK, Czeslaw. “Current state and development of Airbnb accommodation offer in 167 countries”. Current Issues in Tourism, 2019. DOI: https://doi.org/10.1080/13683500.2019.1696758

AIRBNB, About us, [online] [accessed: 2021]. Available at: https://press.airbnb.com/about-us/

BRESCIANI, Stefano, FERRARIS, Alberto, SANTORO, Gabriele, PREMAZZI, Katia, QUAGLIA, Roberto, YAHIAOUI, Dorra and VIGLIA, Giampaolo. The seven lives of Airbnb. The role of accommodation types. In: Annals of Tourism Research. No. 88, 103170. ISSN: 0160-7383. DOI: https://doi.org/10.1016/j.annals.2021.103170

DOGRU, Tarik and Mody, Makarand and SUESS, Courtney. Adding evidence to the debate: Quantifying Airbnb’s disruptive impact on ten key hotel markets. In: Tourism Management. 2019. No, 72 pages 27–38. ISSN: 0261-5177. DOI: https://doi.org/10.1016/j.tourman.2018.11.008

DOLING, John. ’Not for housing’ housing: Widening the scope of housing studies. In: Critical Housing Analysis. Vol. 6, no. 1, pages 22–31. DOI: http://dx.doi.org/10.13060/23362839.2019.6.1.450

DOLNICAR, Sara. A review of research into paid online peer-to-peer accommodation. In: Annals of Tourism Research. Vol. 75, pages 248–264. ISSN: 0160-7383. DOI: https://doi.org/10.1016/j.annals.2019.02.003

DOLNICAR, Sara and ZARE, Samira. COVID19 and Airbnb – Disrupting the disruptor. In: Annals of Tourism Research. 2020. Vol. 83, 102961. ISSN: 0160-7383. DOI: http://dx.doi.org/10.1016/j.annals.2020.102961

DREDGE, Dianne and GYIMÓTHY, Szilvia. The collaborative economy and tourism: Critical perspectives, questionable claims and silenced voices. In: Tourism Recreation Research. 2015. Vol. 40, pages 286–302. ISSN: 0250-8281. DOI:http://dx.doi.org/10.1080/02508281.2015.1086076

FARMAKI, Anna, MIGUEL, Cristina, DROTAROVA, Maria H, ALEKSIĆ, Anna, ČASNI, ANITA Č. y EFTHYMIADOU, Fani. Impacts of Covid-19 on peer-to-peer accommodation platforms: Host perceptions and responses. In: International Journal of Hospitality Management, 91(61), 102663. ISSN: 0278-4319. DOI: https://dx.doi.org/10.1016%2Fj.ijhm.2020.102663

FENG, Linyan. A scorecard breaking down everyone from Xiaozhu, Tujia to Airbnb. EqualOcean. https://equalocean.com/analysis/201902091384, 2019.

GUTTENTAG, Daniel. Progress on Airbnb: a literature review. Journal of Hospitality and Tourism Technology, 10(4), 814–844. ISSN: 1757-9880. DOI: http://dx.doi.org/10.1108/JHTT-08-2018-0075

HAHSLER, Michael, PIEKENBROCK, Matthew and DORAN, Derek. dbscan: Fast density-based clustering with R. In: Journal of Statistical Software, 91(1), 1–30. ISSN: 1548-7660. DOI: http://dx.doi.org/10.18637/jss.v091.i01

HAJIBABA, Homa and DOLNICAR, Sara. Airbnb and its competitors. In: Dolnicar, Sara. (ed.). Peer-to-peer accommodation networks: Pushing the boundaries. Oxford: Goodfellow Publishers, 2018. ISBN-10: 1911396528 ISBN-13: 978-1911396529. DOI: http://dx.doi.org/10.23912/9781911396512-3604

JELSKI, Christina. Airbnb says it beat its revenue projections for 2020. Travel Weekly. https://www.travelweekly.com/Travel-News/Hotel-News/Airbnb-says-it-beat-its-revenue-projections-for-2020, 2021

KADI, Justin, SCHNEIDER, Antonia and SEIDL, Roman. Short-term rentals, housing markets and COVID-19: Theoretical considerations and empirical evidence from four Austrian cities. In: Critical Housing Analysis, 7(2), 47–57. ISSN: 2336-2839. DOI: https://dx.doi.org/10.13060/23362839.2020.7.2.514

KE, Qing. Sharing means renting?: An entire-marketplace analysis of Airbnb. In: Proceedings of the 2017 ACM on Web Science Conference – WebSci ’17, Troy, NY, USA, June 25–28, 2017. ISBN: 978-1-4503-4896-6. DOI: http://dx.doi.org/10.2139/ssrn.2902840

NATURAL EARTH. (2021). https://www.naturalearthdata.com/, 2021

OSKAM, Jeroen A. The future of Airbnb and the ‘sharing economy’: The collaborative consumption of our cities. Bristol: Channel View, 2019. ISBN-10: 1845416724 ISBN-13: 978-1845416720.

SCHAAL, Dennis. (2020a). “Airbnb Share Price More Than Doubles in First Day of Historic Public Debut”. Skift. https://skift.com/2020/12/10/airbnb-share-price-more-than-doubles-in-first-day-of-historic-public-debut/, 2020a

SCHAAL, Dennis. Airbnb CEO Brian Chesky Poised for New Era of Travel Redistribution: The Long View This Week. Skift.https://skift.com/2020/04/24/airbnb-ceo-brian-chesky-poised-for-new-era-of-travel-redistribution-the-long-view-this-week/, 2020b

SLEE, Tom. Data collection for Airbnb listings.https://github.com/tomslee/airbnb-data-collection , 2018

WEGMANN, Jake and JIAO, Junfeng. Taming Airbnb: Toward guiding principles for local regulation of urban vacation rentals based on empirical results from five US cities. Land Use Policy, 69, 494–501. DOI: https://doi.org/10.1016/j.landusepol.2017.09.025

ZHANG, Mo, GENG, Rouqi., HUANG, Yuan and REN, Shengce. Terminator or accelerator? Lessons from the peer-to-peer accommodation hosts in China in responses to COVID-19. International Journal of Hospitality Management, 102760. DOI: https://doi.org/10.1016/j.ijhm.2020.102760

ADAMIAK, Czesław. Changes in the global Airbnb offer during the COVID-19 pandemic. Oikonomics [online]. May 2021, no. 15. ISSN: 2339-9546. DOI:https://doi.org/10.7238/o.n15.2107

ODS

Czesław Adamiak

Czesław AdamiakCzesław Adamiak is a PhD in geography, works at the Faculty of Earth Sciences and Spatial Management, Nicolaus Copernicus University in Toruń (Poland). His research interests include tourism geography, regional development, and the applications of geographic information systems and big data in social sciences. His current research focuses on the role of online peer-to-peer rental platforms in tourism behaviour and the evolution of tourism destinations.